ICT Market Tendencies

The UK ICT market is the largest in Europe in terms of market value and represents around one fifth of the total EU market. The country continues to remain one of the favourite European destinations for software and services companies, as it is home for more than 100,000 software specialist houses (cf. ukinvest.gov.uk).

London and its surroundings are considered the pole of knowledge-driven headquarters. The capital city has the highest concentration of telecommunication, services and computer equipment companies of any European capital. Its cultural background makes it the number one destination for North American ICT businesses in Europe.

25% of the channel's main players account for about 80% of total turnover. Due to severe declines in profit margins, the number of channel players continues to decrease and further restriction of the activity is expected to take place in the field.

The SMB sector remains one of the growth drivers of the ICT business as there is plenty of room for development in this sector. More than two-thirds of the channel players orient their sales towards this category of company. Retail plays an important role, as small companies often obtain IT products through mass distribution.

Some dynamic niche markets such as security, virtualization and storage continue to expand, while the biggest companies consolidate their market presence through further M&As. Security product ranges and solutions pursue their growth trend in the UK market, as the country controls one fifth of the global market for IT security products.

The revenue split by activity indicates that the main channel engine and one of the fastest growing segments is the services sector as it represents more than 60% of all channel revenues. Business Process Outsourcing has reached maturity and remains an important source of revenue for the industry. India continues to be the favourite destination, due to the inexpensive, high-quality skills available.

Britain is particularly strong in the areas of e-technologies, parallel computing, artificial intelligence, virtualization and multimedia software development. Upgrading remains of great interest due to continuous improvements in hardware and software. Data is still of great value for any organization and all connected ICT activities benefit from this. Sales based on ERP/CRM software will slow down, to continue their growth trend after the critical period. In exchange, BI and web 2.0 applications still continue to grow. The software market is also sustained by the public sector heavily investing in this area.

The telecom market is driven by continuing investment, and converged services are now a very common offer on the market. Innovation, inventiveness and creativity continue to remain major selling points for the UK market.

The ICT consumer market is also mature, very competitive and therefore price oriented. The market is renowned for its leisure software. UK continues to be the third-largest global market accounting for up to one-third of global games software sales.

Finally, the UK keeps a strong business influence on the Nordic countries, South Africa, and the Middle East, which closely follow the British market model.

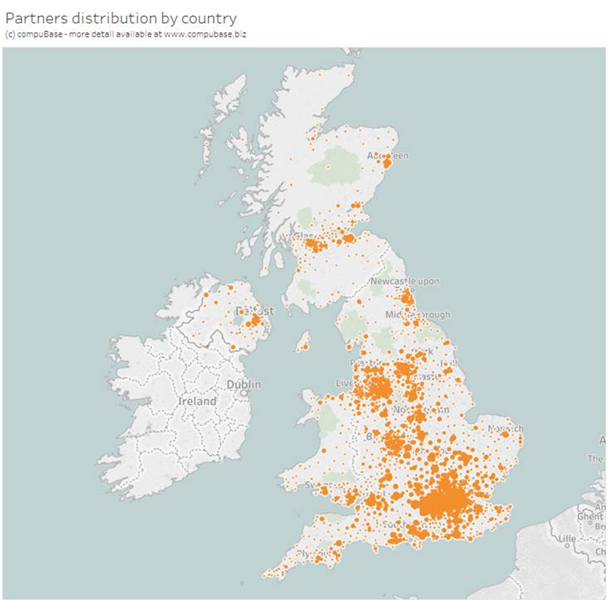

The following image shows the concentration ICT partners in our database for the UK

London and its surroundings are considered the pole of knowledge-driven headquarters. The capital city has the highest concentration of telecommunication, services and computer equipment companies of any European capital. Its cultural background makes it the number one destination for North American ICT businesses in Europe.

25% of the channel's main players account for about 80% of total turnover. Due to severe declines in profit margins, the number of channel players continues to decrease and further restriction of the activity is expected to take place in the field.

The SMB sector remains one of the growth drivers of the ICT business as there is plenty of room for development in this sector. More than two-thirds of the channel players orient their sales towards this category of company. Retail plays an important role, as small companies often obtain IT products through mass distribution.

Some dynamic niche markets such as security, virtualization and storage continue to expand, while the biggest companies consolidate their market presence through further M&As. Security product ranges and solutions pursue their growth trend in the UK market, as the country controls one fifth of the global market for IT security products.

The revenue split by activity indicates that the main channel engine and one of the fastest growing segments is the services sector as it represents more than 60% of all channel revenues. Business Process Outsourcing has reached maturity and remains an important source of revenue for the industry. India continues to be the favourite destination, due to the inexpensive, high-quality skills available.

Britain is particularly strong in the areas of e-technologies, parallel computing, artificial intelligence, virtualization and multimedia software development. Upgrading remains of great interest due to continuous improvements in hardware and software. Data is still of great value for any organization and all connected ICT activities benefit from this. Sales based on ERP/CRM software will slow down, to continue their growth trend after the critical period. In exchange, BI and web 2.0 applications still continue to grow. The software market is also sustained by the public sector heavily investing in this area.

The telecom market is driven by continuing investment, and converged services are now a very common offer on the market. Innovation, inventiveness and creativity continue to remain major selling points for the UK market.

The ICT consumer market is also mature, very competitive and therefore price oriented. The market is renowned for its leisure software. UK continues to be the third-largest global market accounting for up to one-third of global games software sales.

Finally, the UK keeps a strong business influence on the Nordic countries, South Africa, and the Middle East, which closely follow the British market model.

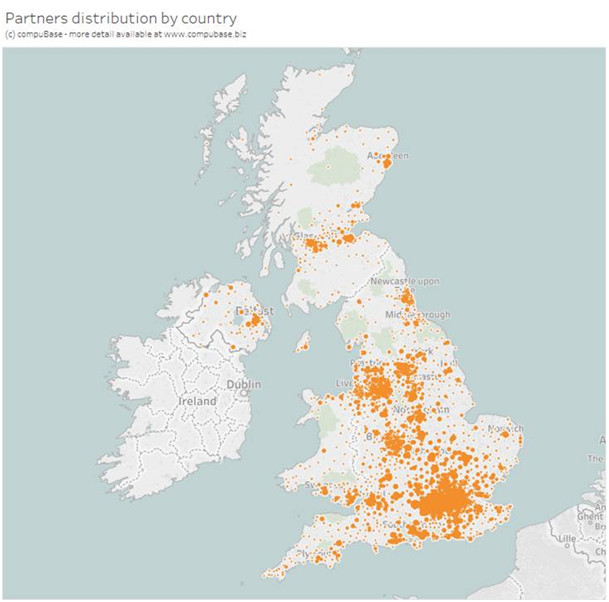

The following image shows the concentration ICT partners in our database for the UK

Database United Kingdom - Click on any cell in the table to see the corresponding selection

FURTHER SOURCES OF INFORMATION

Distribution players:

INGRAM MICRO UK LTD -HQ ; TECHDATA ; NORTHAMBER PLC ; SPICERS LTD UK ; MIDWICH Ltd UK

IT Channel Press & Players:

Computer Weekly (REED BUSINESS INFORMATION) ; European Reseller Magazine ; CRN (VNU); MicroScope.co.uk

Public organisations & Useful Associations:

TECH UK ; International Capital Market Association ; Internet Service Providers Association.org.uk ; Direct Marketing Association UK ; Worshipful Company of Information Technologists ; British Interactive Media Association (BIMA)

INGRAM MICRO UK LTD -HQ ; TECHDATA ; NORTHAMBER PLC ; SPICERS LTD UK ; MIDWICH Ltd UK

IT Channel Press & Players:

Computer Weekly (REED BUSINESS INFORMATION) ; European Reseller Magazine ; CRN (VNU); MicroScope.co.uk

Public organisations & Useful Associations:

TECH UK ; International Capital Market Association ; Internet Service Providers Association.org.uk ; Direct Marketing Association UK ; Worshipful Company of Information Technologists ; British Interactive Media Association (BIMA)

Consulting Services

Consulting Services