ICT Market Tendencies

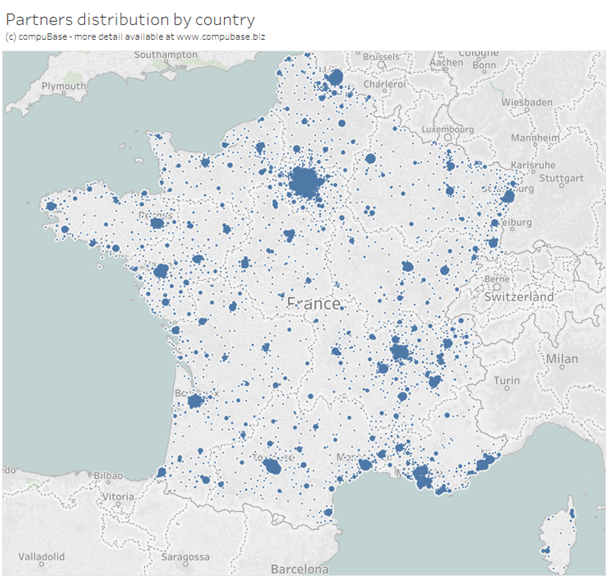

The third-largest European market, and totalizing around 15% of the total EU ICT market value, the French ICT market is characterized by an ongoing trend to increase regional regain of power in terms of activity over the capital region. The Ile de France has long been and still remains the leader in terms of turnover and the number of headquarters. However, with the development of multimedia products and the expansion of Internet IT (resale and SaaS), this might change to the benefit of the rest of the country in the coming years.

France also exercises an important influence on the distribution of other French-speaking countries such as South Belgium, a part or Switzerland, North African countries and Western Africa.

In general, the French ICT distribution channel tends to be more granular and more centralized than in the UK or Germany (but much less when compared to Italy and Spain). One can notice the striking difference between the capital region (Ile de France), dominated by IT specialists, and the provinces mainly comprising VARs (74% of VARs are located outside the capital region). ISV players tend to be more concentrated in the capital and its surroundings.

Another specific feature of French IT & Telecom is the increasing importance of the mass distribution channel, especially for the small entities. Retail is dominant on the digital home products market. Moreover, small entities use retail to satisfy their regular shopping habits. The public sector– targeted by almost half of the channel players -- has also gained in size and therefore contributed to growth in the IT sector via Internet access to certain key business services such as VAT declarations, customs declarations, and the payroll taxes. More than one-third of IT revenue comes from the public sector. The French government plays an important role in stimulating R&D by means of two important measures: the research and development tax credit and assisted or guaranteed government loans (Oséo).

The sector should be driven by outsourcing contracts, which will become more specialized. The services sector continues to be the most dynamic in volume of creations, but also in terms of disappearances.

The French software distribution market follows the granularity law where wholesalers continue to play an important role in the distribution of this product category. The French software market is currently more and more focused on SaaS and Cloud.

The security products market is closely related to online activities. French consumers are known for spending more for a better service, which for Internet services rhymes with improved security.

ERP, CRM and SCM still and constantly contribute to the expansion of the software market. Alternative operators are increasingly offering their packaged services at accessible prices, thus staking out their own place in the IT & Telecom market. Further investments will be performed in the telecom sector, especially in LAN and IP services.

The growth in the consumer electronic market will be moderate as well; the most solicited products continue to be digital products and smartphones.

compuBase regional and sectorial studies on France (in French)

The following image shows the concentration of ICT partners in our database for France

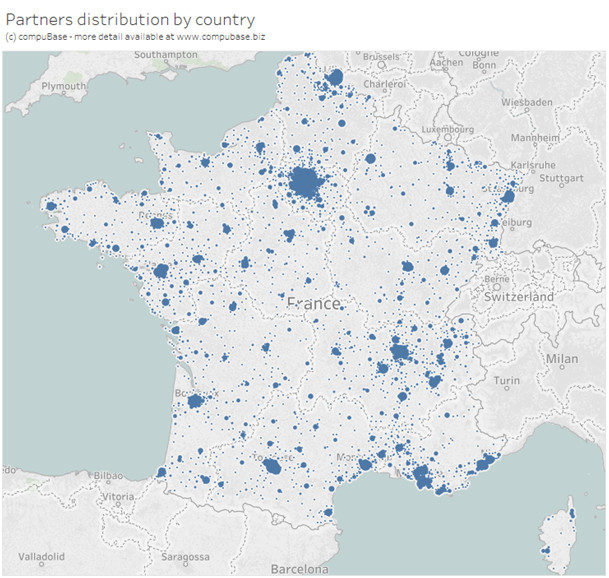

France also exercises an important influence on the distribution of other French-speaking countries such as South Belgium, a part or Switzerland, North African countries and Western Africa.

In general, the French ICT distribution channel tends to be more granular and more centralized than in the UK or Germany (but much less when compared to Italy and Spain). One can notice the striking difference between the capital region (Ile de France), dominated by IT specialists, and the provinces mainly comprising VARs (74% of VARs are located outside the capital region). ISV players tend to be more concentrated in the capital and its surroundings.

Another specific feature of French IT & Telecom is the increasing importance of the mass distribution channel, especially for the small entities. Retail is dominant on the digital home products market. Moreover, small entities use retail to satisfy their regular shopping habits. The public sector– targeted by almost half of the channel players -- has also gained in size and therefore contributed to growth in the IT sector via Internet access to certain key business services such as VAT declarations, customs declarations, and the payroll taxes. More than one-third of IT revenue comes from the public sector. The French government plays an important role in stimulating R&D by means of two important measures: the research and development tax credit and assisted or guaranteed government loans (Oséo).

The sector should be driven by outsourcing contracts, which will become more specialized. The services sector continues to be the most dynamic in volume of creations, but also in terms of disappearances.

The French software distribution market follows the granularity law where wholesalers continue to play an important role in the distribution of this product category. The French software market is currently more and more focused on SaaS and Cloud.

The security products market is closely related to online activities. French consumers are known for spending more for a better service, which for Internet services rhymes with improved security.

ERP, CRM and SCM still and constantly contribute to the expansion of the software market. Alternative operators are increasingly offering their packaged services at accessible prices, thus staking out their own place in the IT & Telecom market. Further investments will be performed in the telecom sector, especially in LAN and IP services.

The growth in the consumer electronic market will be moderate as well; the most solicited products continue to be digital products and smartphones.

compuBase regional and sectorial studies on France (in French)

The following image shows the concentration of ICT partners in our database for France

Database France - Click on any cell in the table to see the corresponding selection

Create Your Own Count for France Republic With Our Online Selection Tool

compuBase has developed a very powerful but easy to access tool. It allows you to perform targeting and instantly know the volume of potential partners for your activity. The counting functions are accessible without subscription.

FURTHER SOURCES OF INFORMATION

Distribution players:

TECH DATA France ; INGRAM MICRO France SAS ; ETC ; ALSO France ; DEXXON DATA MEDIA France

IT Channel Press & Players:

EDI - www.distributique.fr ; www.itrnews.com - www.channelnews.fr

Public organisations & Useful Associations:

3SCI ; Alliance TICS ; GPNI ; Fédération SYNTEC ; la Mêlée.com

TECH DATA France ; INGRAM MICRO France SAS ; ETC ; ALSO France ; DEXXON DATA MEDIA France

IT Channel Press & Players:

EDI - www.distributique.fr ; www.itrnews.com - www.channelnews.fr

Public organisations & Useful Associations:

3SCI ; Alliance TICS ; GPNI ; Fédération SYNTEC ; la Mêlée.com

Consulting Services

Consulting Services