Cloud, a wide impact

Cloud, a wide impact

The impact of the Cloud on sales methods, distribution networks, technologies, and business models, as well as on corporate cultures and even on how companies operate at a fundamental level has been so important that it marks a major step in the evolution of the profession.

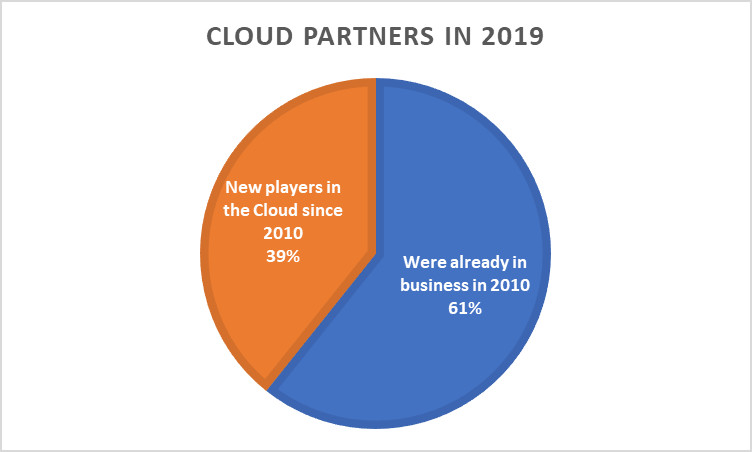

compuBase has a database of 100,000 partners covering the EMEA region, nearly 40% of which base their business models on the Cloud either directly or indirectly, so it can shed some light on how the Cloud has affected the various occupations in our industry.

Although the origins of the Cloud go back to the early 2000s, particularly with the rise of SaaS (formerly ASPs) and players like Amazon (2004), its true expansion in companies dates to the 2010s, with the arrival of solutions on the market from big traditional IT firms like IBM (2013) and Microsoft (2010), the latter of which has fully committed to the movement and is probably most responsible for the idea taking off within traditional IT players.

The Seattle firm has successfully transformed its product line and changed its own corporate culture while also moving its distribution network into the Cloud; on their own, pure players would never have been able to shift the market so quickly.

Microsoft has been unshakable in its desire to pursue the Cloud path, but has done so while guiding its most dynamic partners through their own economic and technical transformation. When the vast majority of partners realized that the only future Microsoft was offering was through and for the Cloud, most of them, either willingly or by force, changed their own business practices.

The point when the market tipped toward the Cloud was in 2014, when Microsoft Office sales in traditional versions began to stagnate and then decline. In 2017, Office 365 came out on top for good in terms of revenue generated.

Does this mean that Cloud is all that’s left? Far from it. There are still many players whose models ignore the Cloud or have simply not wanted to make the transition.

Below are a few charts with descriptions to give you some more information about how the profession has changed.

The impact of the Cloud on sales methods, distribution networks, technologies, and business models, as well as on corporate cultures and even on how companies operate at a fundamental level has been so important that it marks a major step in the evolution of the profession.

compuBase has a database of 100,000 partners covering the EMEA region, nearly 40% of which base their business models on the Cloud either directly or indirectly, so it can shed some light on how the Cloud has affected the various occupations in our industry.

Although the origins of the Cloud go back to the early 2000s, particularly with the rise of SaaS (formerly ASPs) and players like Amazon (2004), its true expansion in companies dates to the 2010s, with the arrival of solutions on the market from big traditional IT firms like IBM (2013) and Microsoft (2010), the latter of which has fully committed to the movement and is probably most responsible for the idea taking off within traditional IT players.

The Seattle firm has successfully transformed its product line and changed its own corporate culture while also moving its distribution network into the Cloud; on their own, pure players would never have been able to shift the market so quickly.

Microsoft has been unshakable in its desire to pursue the Cloud path, but has done so while guiding its most dynamic partners through their own economic and technical transformation. When the vast majority of partners realized that the only future Microsoft was offering was through and for the Cloud, most of them, either willingly or by force, changed their own business practices.

The point when the market tipped toward the Cloud was in 2014, when Microsoft Office sales in traditional versions began to stagnate and then decline. In 2017, Office 365 came out on top for good in terms of revenue generated.

Does this mean that Cloud is all that’s left? Far from it. There are still many players whose models ignore the Cloud or have simply not wanted to make the transition.

Below are a few charts with descriptions to give you some more information about how the profession has changed.

[1]Find the MSPs and all of Europe's ICT players at www.compubase.biz

Is everyone on the Cloud? …no, far from it

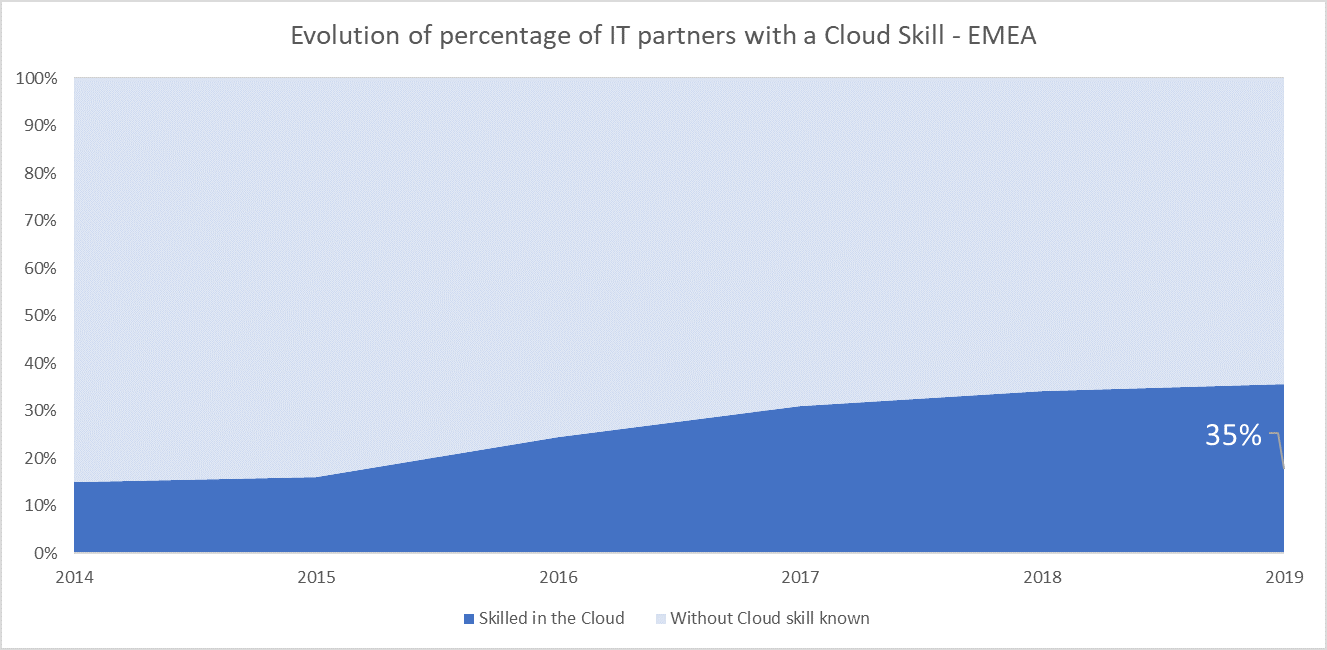

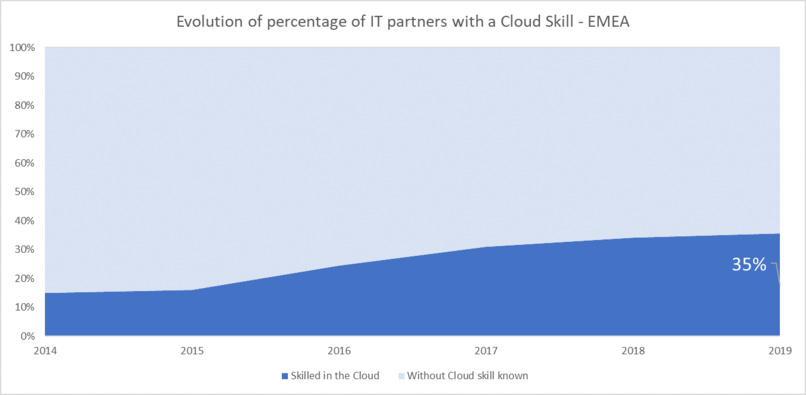

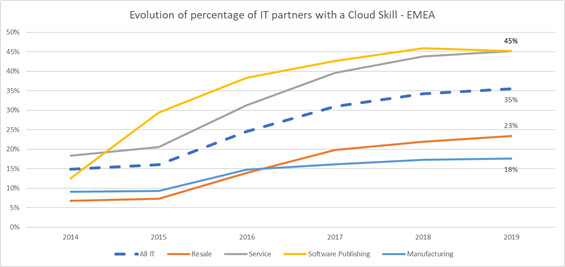

Given the annual cycle at which our information is updated, we estimate that about 40% of IT players across all IT business types now include a Cloud-specific competency.

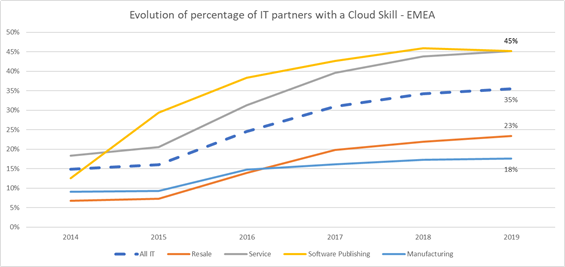

Are all IT business types moving at the same pace?

As we can see among the major categories in the IT sector, the Cloud has been spreading constantly, but it first accelerated at software publishers. Distribution took longer to get started, but as we shall see later, this gradual evolution must also be analyzed in light of the appearance of pure players and the disappearance of a number of actors.

Definition of segments

Distribution includes: Telecom and network infrastructure integrators; Computing infrastructure integrators, Reselling to user companies (assembly, hardware, software, and services), Reselling to individuals, Wholesalers.

Service includes: Integrators of services or software solutions developed by third parties, IT services, digital service companies (hosting, maintenance, training, custom development, etc.), Telecom services (operators, ISPs, etc.), Consultants, Web Agencies, other IT-specific services

Software publishing includes: Non-specialist software publishers, Software publishers devoted to a specific business type or profession, Software publishers devoted to a specific company process

Manufacturers includes: Manufacturers (or exclusive distributors) of IT hardware and telecoms.

Definition of segments

Distribution includes: Telecom and network infrastructure integrators; Computing infrastructure integrators, Reselling to user companies (assembly, hardware, software, and services), Reselling to individuals, Wholesalers.

Service includes: Integrators of services or software solutions developed by third parties, IT services, digital service companies (hosting, maintenance, training, custom development, etc.), Telecom services (operators, ISPs, etc.), Consultants, Web Agencies, other IT-specific services

Software publishing includes: Non-specialist software publishers, Software publishers devoted to a specific business type or profession, Software publishers devoted to a specific company process

Manufacturers includes: Manufacturers (or exclusive distributors) of IT hardware and telecoms.

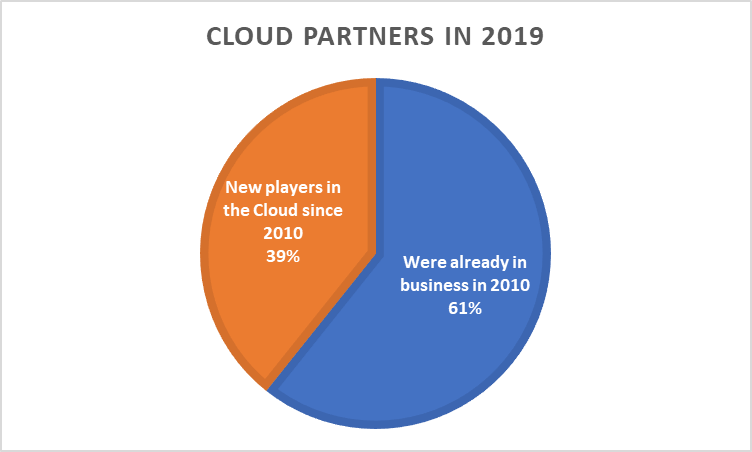

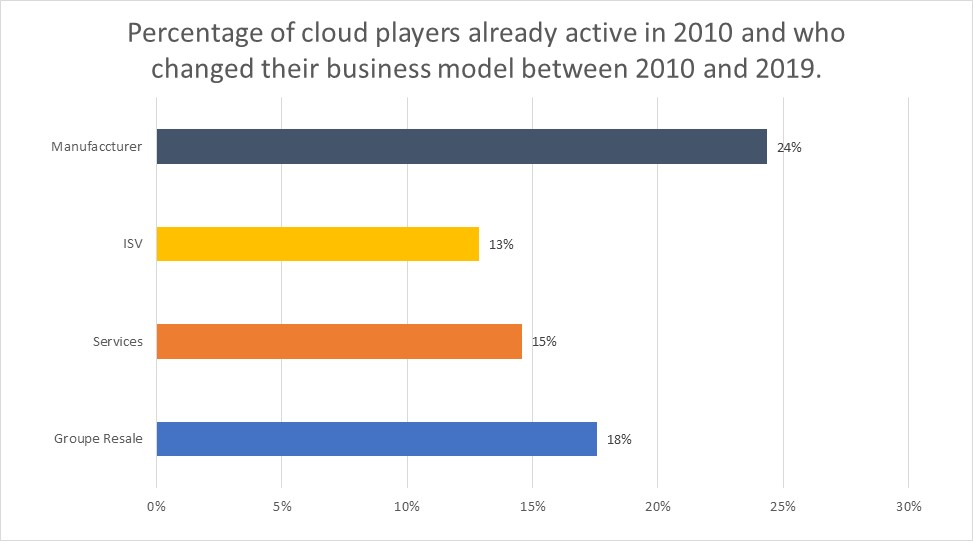

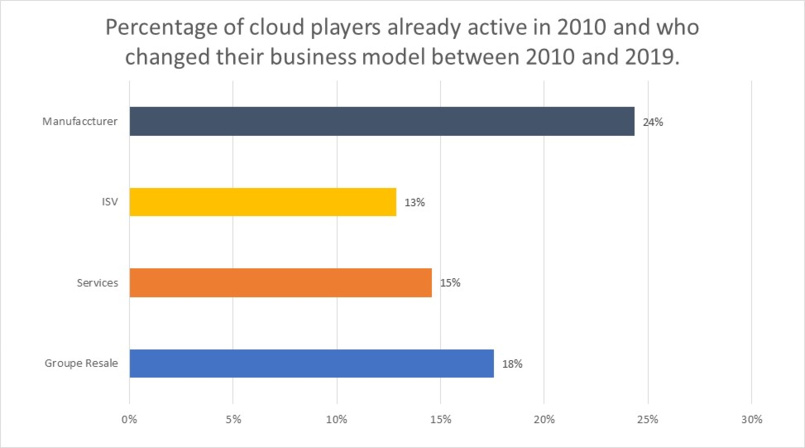

The other thing to note is that some players, which are now active in the Cloud, changed their business model in 2000-2020 and switched to a new type of business (15% overall). Below are the details by type of partners that changed what they do business in.

The following sections are visible in the downloadable study

- Change by activity Change at ISVs

- Cloud ecosystem analysis in EMEA by type of player (in terms of volume)

- MSP analysis (managed services providers and resellers)

- Studying MSPs in terms of what services they offer

- 15 most common brands among MSP

- Comparison of Cloud penetration in EMEA by country.

- Conclusion

Download the full EMEA study here

You can also download the same study for France only

- Changes at service providers

- Changes at resellers

- Cloud ecosystem analysis in EMEA by type of player (in terms of volume)

- MSP analysis (managed services providers and resellers)

- Studying MSPs in terms of what services they offer

- 15 most common brands among MSP

- Comparison of Cloud penetration in EMEA by country.

- Conclusion

Download the full EMEA study here

You can also download the same study for France only

Consulting Services

Consulting Services