compuBase has coverage across five continents (we do not cover yet Asia) and constantly updates its database. To do this, we use official sources as well as various other methods to quickly detect changes in the industry.

Our market coverage generally represents 85% of the industry's turnover. To achieve this representation, it is often sufficient to cover between 50% and 65% of the companies, depending on the concentration of activity, which varies greatly by country. The long tail, representing the remaining 15% of the turnover, is made up by the rest of the companies.

Therefore, by nature, the companies with more than 5 employees in the compuBase database overweight the actual market.

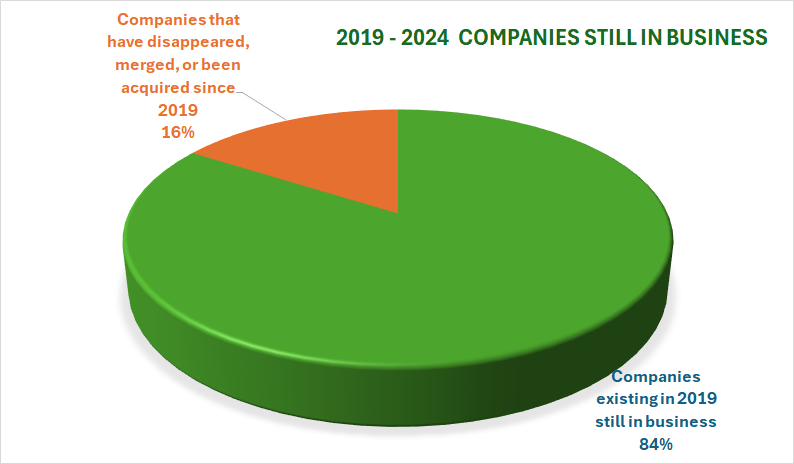

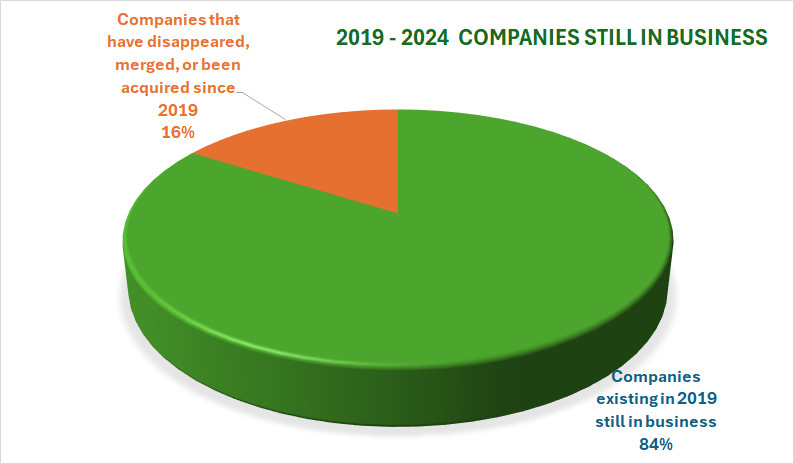

Smaller enterprises have a higher turnover rate (disappearance/creation) than larger ones.

As a result, the percentages of disappearance indicated below underrepresent the reality but give a clue how fast the business is changing.

Our market coverage generally represents 85% of the industry's turnover. To achieve this representation, it is often sufficient to cover between 50% and 65% of the companies, depending on the concentration of activity, which varies greatly by country. The long tail, representing the remaining 15% of the turnover, is made up by the rest of the companies.

Therefore, by nature, the companies with more than 5 employees in the compuBase database overweight the actual market.

Smaller enterprises have a higher turnover rate (disappearance/creation) than larger ones.

As a result, the percentages of disappearance indicated below underrepresent the reality but give a clue how fast the business is changing.

How many IT companies that existed in 2019 are still alive in 2024?

To compile these statistics, we took the complete compuBase database and compared the companies from 2019 with our current database.

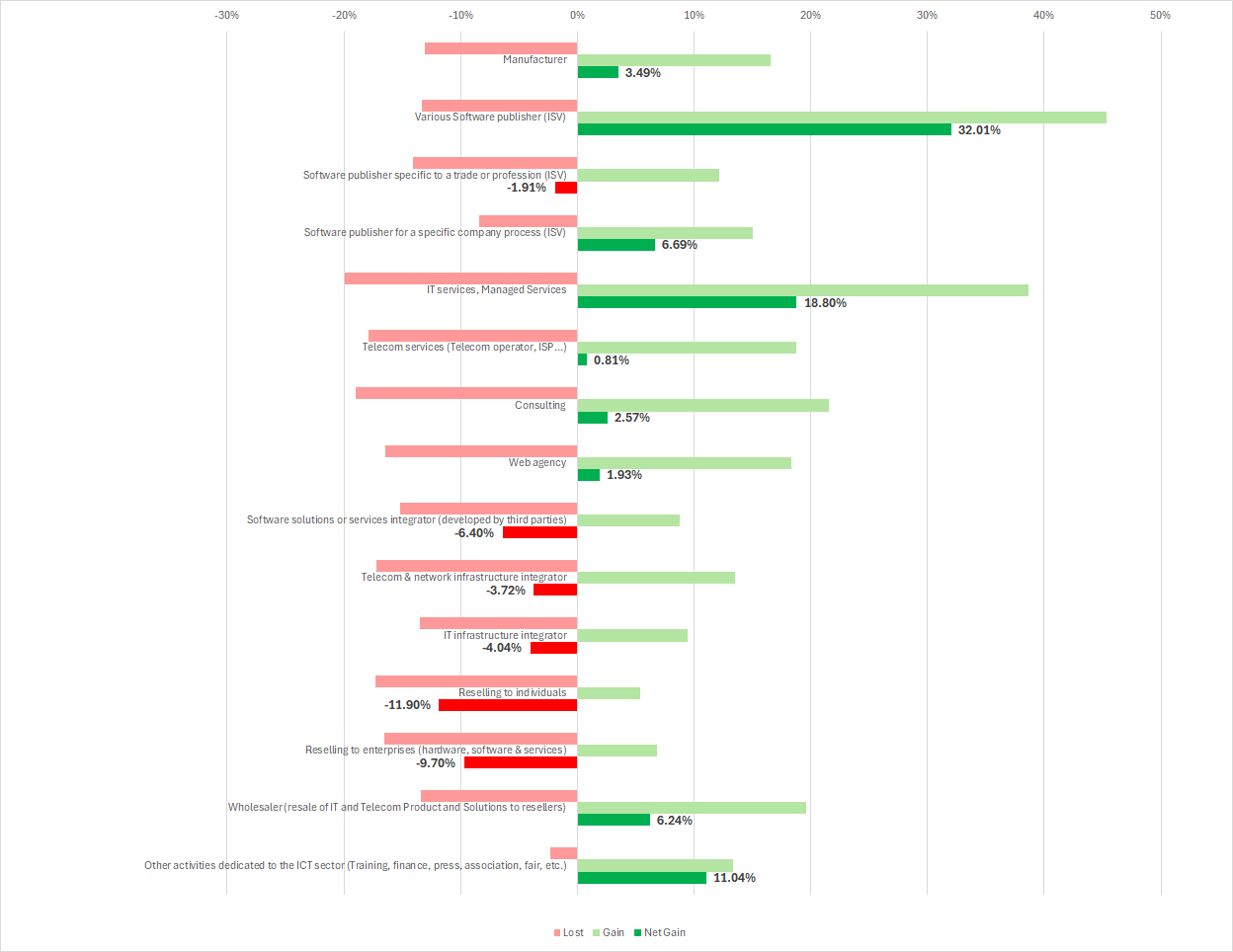

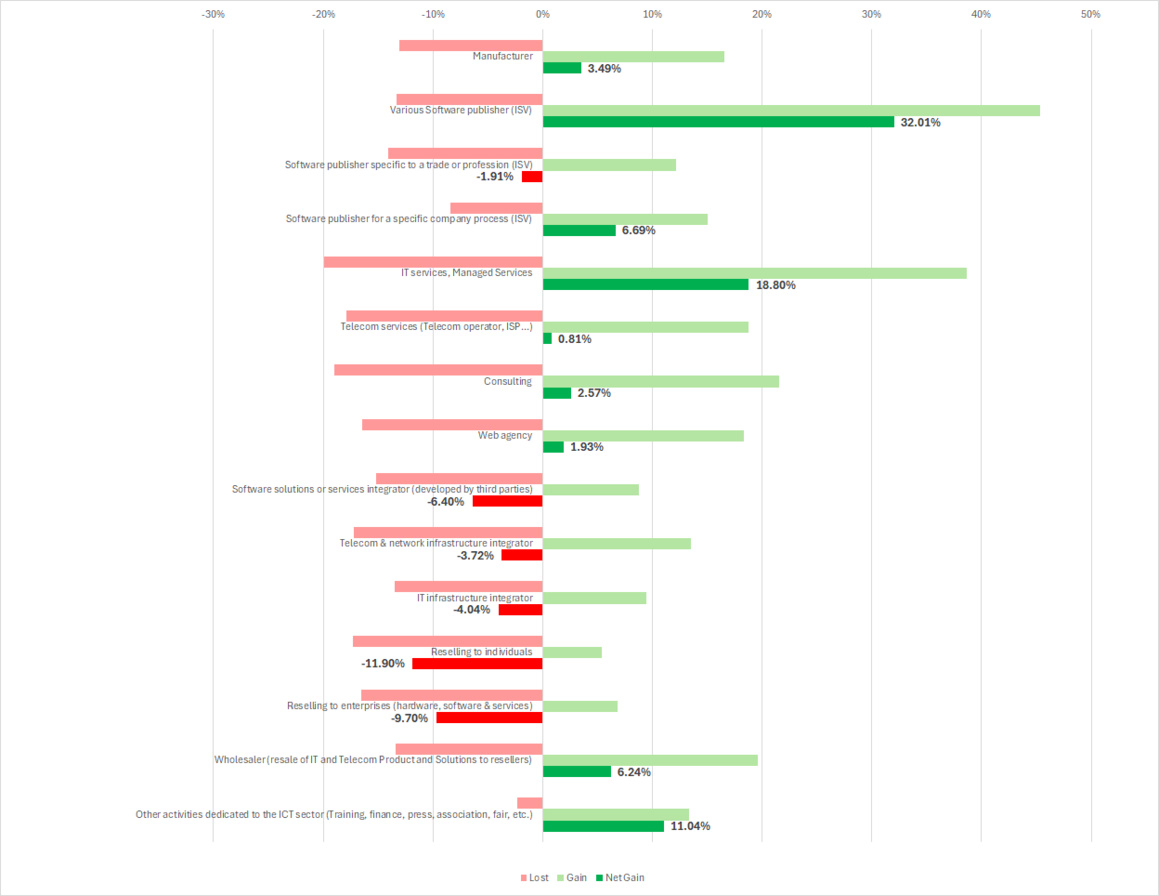

What are the winning or losing activities?

The activities described below come from our EMEA database. Indeed, in order not to bias the study, we have excluded the US database, whose coverage of ISVs has greatly increased over the last few years.

The growth or decline of an activity can have several sources:

The growth or decline of an activity can have several sources:

- The emergence of new companies with the main activity mentioned.

- The change in activity of an existing company, for example, a reseller becoming a service company

Analysis of the evolution of the different activities

There are numerous lessons to be learned from the evolution of IT activities.

Evolution of the Software Publishers Segment

The software publishing sector is very dynamic.

The development of SaaS solutions distribution has had several significant consequences:

This segment includes three sub-categories: software solution integrators, IT infrastructure integrators, and telecom infrastructure integrators. Software solution integrators have suffered from the development of the SaaS model, which naturally requires less integration effort into the IT system and often offers more interoperability thanks to APIs and web services.

IT infrastructure integrators have had a mixed evolution because, on one hand, the development of cloud hosting sites has supported server demand for large actors, but on the other, cloud hosting has reduced demand for smaller actors, thus forcing them to evolve their business towards MSP.

Telecom and network integrators have undergone a parallel erosion, with the development of IPBX often benefiting telecom operators more and reducing the need for purely telecom infrastructure.

Evolution of the IT & Telecom Resale Segment

This segment includes three sub-categories: retail to the general public, B2B resale, and wholesalers. Among wholesalers, the concentration seen in recent years has slowed down somewhat, as the number of sizable targets has decreased, but there's no doubt that margin pressure and the evolution of business niches will offer new opportunities. The segment's growth is explained by the development of the Cloud broker business. Traditional distribution activities continue to erode. Public resellers are, of course, competed with by online sales, while B2B resellers face a demand for physical products that has continued to decrease. The Covid-related boost benefited them only partially and temporarily. They are thus naturally pushed to consolidate and move towards more lucrative service activities, which offer the opportunity to develop recurring revenues. Let's not forget the impact of age, as many of these companies were founded in the 80s, and their leaders have either already handed over or are about to do so.

Evolution of the IT & Telecom Services Segment

This segment includes five sub-categories: IT service companies (MSP, Maintenance...), telecom companies, web agencies, consulting firms, and a peripheral segment that contains actors whose activity is primarily related to the IT sector. Service activities are the main beneficiaries of technology evolution. Here is a list, surely non-exhaustive, explaining this strong push:

Evolution of the Software Publishers Segment

The software publishing sector is very dynamic.

The development of SaaS solutions distribution has had several significant consequences:

- The dematerialization of software solutions promotes a more international commercial approach, thereby strengthening actors with high visibility.

- The high granularity of vertical actors, often hyper-specialized in functional niche markets, has often hindered their evolution towards a SaaS model, to the benefit of larger actors expanding their competencies or existing solutions to the most interesting niches.

- The lack of financial or human resources has also been a hindrance for business software publishers, but they are often better protected from competition due to their specialization and knowledge of the vertical market, or even due to the legal constraints of the country.

Finally, the sector also finds dynamism in the shift of services from offline to online mode, which naturally tend to become software platforms. This is especially strong as the search for recurring revenues has become the watchword of the profession as a whole (CAPEX to OPEX).

Evolution of the IT & Telcom Integrators Segment This segment includes three sub-categories: software solution integrators, IT infrastructure integrators, and telecom infrastructure integrators. Software solution integrators have suffered from the development of the SaaS model, which naturally requires less integration effort into the IT system and often offers more interoperability thanks to APIs and web services.

IT infrastructure integrators have had a mixed evolution because, on one hand, the development of cloud hosting sites has supported server demand for large actors, but on the other, cloud hosting has reduced demand for smaller actors, thus forcing them to evolve their business towards MSP.

Telecom and network integrators have undergone a parallel erosion, with the development of IPBX often benefiting telecom operators more and reducing the need for purely telecom infrastructure.

Evolution of the IT & Telecom Resale Segment

This segment includes three sub-categories: retail to the general public, B2B resale, and wholesalers. Among wholesalers, the concentration seen in recent years has slowed down somewhat, as the number of sizable targets has decreased, but there's no doubt that margin pressure and the evolution of business niches will offer new opportunities. The segment's growth is explained by the development of the Cloud broker business. Traditional distribution activities continue to erode. Public resellers are, of course, competed with by online sales, while B2B resellers face a demand for physical products that has continued to decrease. The Covid-related boost benefited them only partially and temporarily. They are thus naturally pushed to consolidate and move towards more lucrative service activities, which offer the opportunity to develop recurring revenues. Let's not forget the impact of age, as many of these companies were founded in the 80s, and their leaders have either already handed over or are about to do so.

Evolution of the IT & Telecom Services Segment

This segment includes five sub-categories: IT service companies (MSP, Maintenance...), telecom companies, web agencies, consulting firms, and a peripheral segment that contains actors whose activity is primarily related to the IT sector. Service activities are the main beneficiaries of technology evolution. Here is a list, surely non-exhaustive, explaining this strong push:

- Fundamental movement from CAPEX to OPEX

- Remote work and increased cybersecurity needs

- Development of virtualization, favoring migration to the Cloud

- Dematerialization of the offer, pushing transactional sales actors to migrate towards service activities and recurring revenues.

- The emergence of disruptive technologies such as AI

- Needs for interoperability between platforms and systems and dematerialization of documents

- Growing needs in data and flow analysis.

- Shift of offline services to online mode.

- Shift of software from an "on-premise" to a SaaS model (e.g., MS Office to Office 365)

For the last segment of this category, the significant evolution comes from the fact that we have shifted IT training companies, IT shows, IT financing from the IT services companies category to the "Other activities dedicated to the ICT sector (Training, finance, press, association, fair, etc.)".

Consulting Services

Consulting Services