ICT Market Tendencies

Poland is the largest Eastern European ICT market in size. However, when compared to the entire European market, its value is estimated at only 3%. Subject to the considerable commercial and cultural influence of Germany and Russia, the Polish IT market is also characterized by the strong presence of American products, but the importance of domestic products both on the internal and external markets is increasing.

The market is characterized by a certain number of mergers and acquisitions, following the current market situation and in order to gain certain solidity on the market which will help companies compete with their multinational fellows.

The distribution channel in Poland is divided into 46% resale companies, 36% service companies and only 14% software publishers and 4% manufacturers. The B2C e-commerce transactions in Poland are still in a pre-development stage. Nonetheless, more than one fifth of the population currently uses the online sales mode. Large companies are the main end-users, accounting for two thirds of total IT sales, followed by the public sector.

Despite the current market situation, the hardware market remains an important component of the ICT sector as it totalizes almost two thirds of the total IT sector’s sales.

Services now account for around a quarter of the IT sector, but according to forecasts, this is expected to be the most dynamic sector in the years to come. Polish companies, more and more present internationally, are very competitive from both a price and quality standpoint, as their offering is aligned to the current EU standards. Outsourcing also remains quite a dynamic sector, with two digit growth in the past two years.

The software market remains relatively small when compared to the Western European average. It is boosted by application software including ERP, and CRM for SMBs. The e-markets are strong potential markets. E-government, e-learning and e-health are promising sectors. Best prospects also include all kinds of specialized and security software.

The telecom market is the most consistent component of the ICT industry and encloses high potential for development. Mobile telephony and internet broadband access as well as wireless technologies are the three main motors for growth. Telecom equipment currently accounts for about 20% of the overall Polish telecommunications market. Some of the growing markets are development tools for mobile applications and platforms for the mobile content. Poland has 700 active ISPs on the market, who, together with the telecom operators, generate two-thirds of telecom equipment sales. There are also good prospects for high-end digital equipment products, especially audio and visual targeting both the B2B and the B2C public. Technology convergence and digitalization are two dominant trends in the Polish market, offering new market opportunities in the channel.

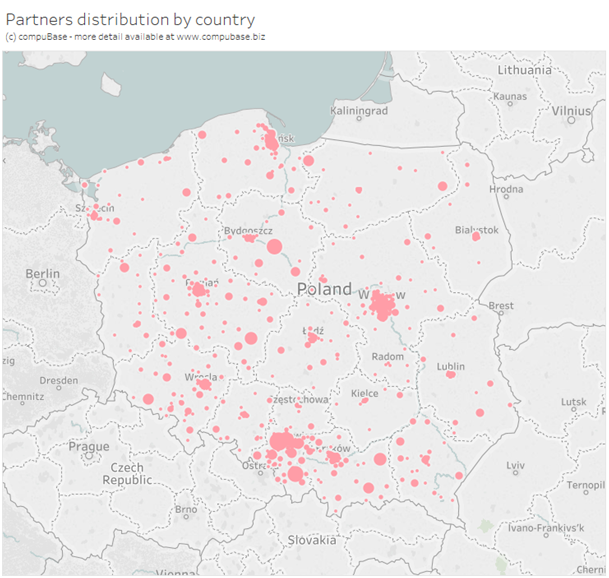

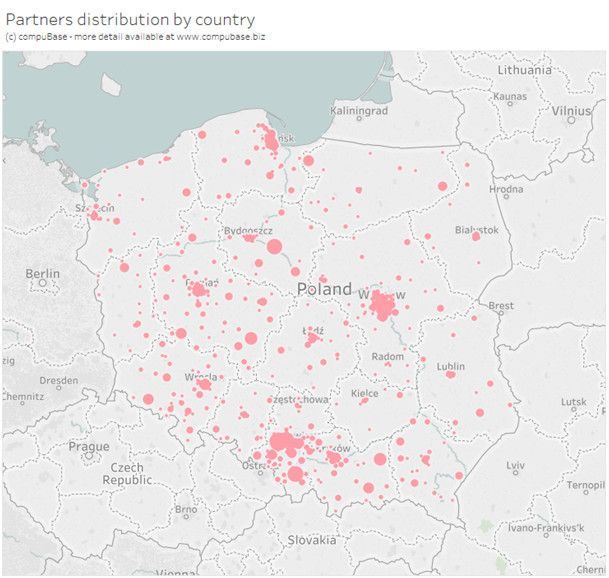

The following image shows the concentration of ICT partners in our database for Poland.

The market is characterized by a certain number of mergers and acquisitions, following the current market situation and in order to gain certain solidity on the market which will help companies compete with their multinational fellows.

The distribution channel in Poland is divided into 46% resale companies, 36% service companies and only 14% software publishers and 4% manufacturers. The B2C e-commerce transactions in Poland are still in a pre-development stage. Nonetheless, more than one fifth of the population currently uses the online sales mode. Large companies are the main end-users, accounting for two thirds of total IT sales, followed by the public sector.

Despite the current market situation, the hardware market remains an important component of the ICT sector as it totalizes almost two thirds of the total IT sector’s sales.

Services now account for around a quarter of the IT sector, but according to forecasts, this is expected to be the most dynamic sector in the years to come. Polish companies, more and more present internationally, are very competitive from both a price and quality standpoint, as their offering is aligned to the current EU standards. Outsourcing also remains quite a dynamic sector, with two digit growth in the past two years.

The software market remains relatively small when compared to the Western European average. It is boosted by application software including ERP, and CRM for SMBs. The e-markets are strong potential markets. E-government, e-learning and e-health are promising sectors. Best prospects also include all kinds of specialized and security software.

The telecom market is the most consistent component of the ICT industry and encloses high potential for development. Mobile telephony and internet broadband access as well as wireless technologies are the three main motors for growth. Telecom equipment currently accounts for about 20% of the overall Polish telecommunications market. Some of the growing markets are development tools for mobile applications and platforms for the mobile content. Poland has 700 active ISPs on the market, who, together with the telecom operators, generate two-thirds of telecom equipment sales. There are also good prospects for high-end digital equipment products, especially audio and visual targeting both the B2B and the B2C public. Technology convergence and digitalization are two dominant trends in the Polish market, offering new market opportunities in the channel.

The following image shows the concentration of ICT partners in our database for Poland.

Database Poland

FURTHER SOURCES OF INFORMATION

Distribution players:

ABC DATA Sp. z o.o. ; INCOM Group SA ; TECH DATA POLSKA Sp. z o.o ; VERACOMP SA Polska Sp. zo.o ; PRAXIS SA

IT Channel Press & Players:

CRN Poland (CMP)

ABC DATA Sp. z o.o. ; INCOM Group SA ; TECH DATA POLSKA Sp. z o.o ; VERACOMP SA Polska Sp. zo.o ; PRAXIS SA

IT Channel Press & Players:

CRN Poland (CMP)

Consulting Services

Consulting Services