ICT Market Tendencies

Ireland has long time taken advantage of its privileged location in the European landscape. Over the past decade its economy has developed a strong fiscal attractiveness allowing the creation of ICT subsidies and an important amount of investment to enter the territory. This market strategy has enabled the country to catch up with its Western European counterpart; nevertheless, the adherence of Eastern countries to the European Union and the expected positive trend of the Irish living standard have led the country to the same global crisis that now affects its neighbours. Ireland was also one of the very first European countries to experience recession, almost thirty years after the high unemployment and emigration period at the beginning of the eighties.

With the same channel SET up as the UK and one of the world’s lowest corporate tax rates (12.5%), combined with a highly skilled and educated workforce, Ireland continues to remain attractive to the ICT business.

The sector accounts for 16% of total added value in the industry and services sectors. Over 85% of the total turnover from the IT sector comes from exports, which makes Ireland strongly dependent on other economies’ health. More than half of the total R&D expenditures concern the technology sector. Innovation represents one of the sectors' top priorities. Ireland's ICT market has reached maturity and continues to remain highly competitive at both national and international level.

The main beneficiaries of this ICT background are U.S. and UK SMB companies, due to both the specificities of their demand and to the common language and cultural background. The IT activity remains concentrated around the highly congested capital region.

The market continues to be driven by mobile computing, security and storage solutions, as well as ERP and CRM software solutions. In the services sector, the top priorities continue to be managed services, systems integration and network development, contrary to enterprise systems and consulting services. The Irish IT sector remains service-oriented not necessarily disposing of a strong added value, which makes the economy rather fragile in a crisis period.

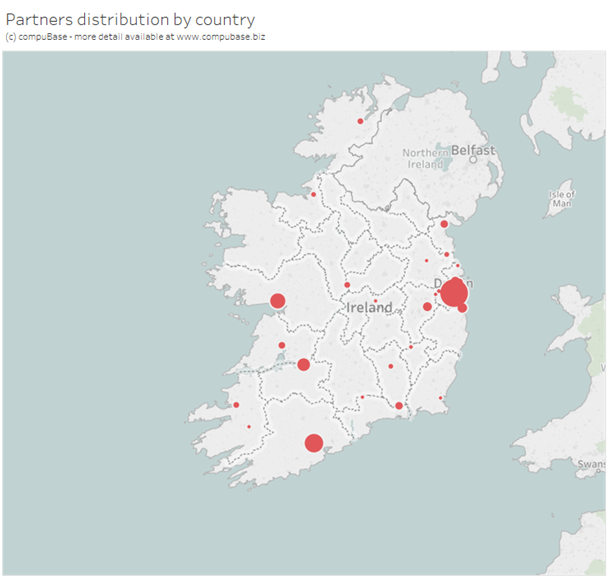

The following image shows the concentration of ICT partners in our database for Ireland

With the same channel SET up as the UK and one of the world’s lowest corporate tax rates (12.5%), combined with a highly skilled and educated workforce, Ireland continues to remain attractive to the ICT business.

The sector accounts for 16% of total added value in the industry and services sectors. Over 85% of the total turnover from the IT sector comes from exports, which makes Ireland strongly dependent on other economies’ health. More than half of the total R&D expenditures concern the technology sector. Innovation represents one of the sectors' top priorities. Ireland's ICT market has reached maturity and continues to remain highly competitive at both national and international level.

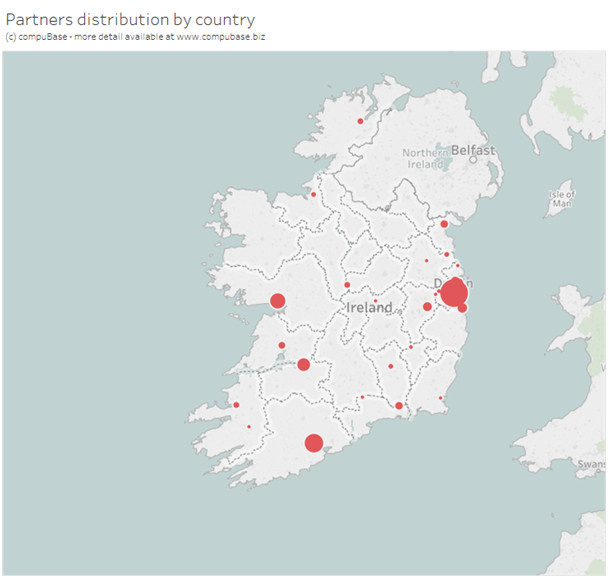

The main beneficiaries of this ICT background are U.S. and UK SMB companies, due to both the specificities of their demand and to the common language and cultural background. The IT activity remains concentrated around the highly congested capital region.

The market continues to be driven by mobile computing, security and storage solutions, as well as ERP and CRM software solutions. In the services sector, the top priorities continue to be managed services, systems integration and network development, contrary to enterprise systems and consulting services. The Irish IT sector remains service-oriented not necessarily disposing of a strong added value, which makes the economy rather fragile in a crisis period.

The following image shows the concentration of ICT partners in our database for Ireland

Database Ireland - Click on any cell in the table to see the corresponding selection

Create Your Own Counts For Rep of Ireland and Europe With Our Online Selection Tool

compuBase has developed a very powerful but easy to access tool. It allows you to perform targeting and instantly know the volume of potential partners for your activity. The counting functions are accessible without subscription.

FURTHER INFORMATION SOURCES

Distribution players:

MICROWARHOUSE ; SPICER Ireland LTD ; TNS Connect LTD ; BELTRONICS COMPUTER Ltd ; ASBIS Ireland

IT Channel Press & Players:

TechCentral ; Computerscope (Ireland Scope Communications Group)

Public organisations & Useful Associations:

Irish Internet Association

MICROWARHOUSE ; SPICER Ireland LTD ; TNS Connect LTD ; BELTRONICS COMPUTER Ltd ; ASBIS Ireland

IT Channel Press & Players:

TechCentral ; Computerscope (Ireland Scope Communications Group)

Public organisations & Useful Associations:

Irish Internet Association

Consulting Services

Consulting Services