ICT Market Tendencies

Due to its geographical features, Italy has gained a reputation of a granular IT market which is very nationally oriented (due to its peninsular shape and geographic “isolation”), making it even more difficult to approach it from the outside. Nevertheless, its location makes the country an entry gate to other Mediterranean markets such as Tunisia, Turkey, Greece, Libya, as well as to the southern Balkan countries.

The Italian ICT market is currently experiencing an increase in the grey economy and a dominance of American companies on the market, since most of them own an Italian subsidiary. At regional level, Lombardy is considered the region with the most highly developed ICT activity, with altogether more than a quarter of the main channel players. Emilia Romagna, Lazio and Veneto each share 10% of the channel players. The other 40% are spread all over the country. Due to the channel’s granularity, local wholesalers have gained more and more importance in ICT distribution. With the emergence of new business models, the number of VARs has also increased compared to the past few years: they currently represent 49% of channel players. Demand in the public sector has also reduced as only 34% of the resellers currently address this market. They tend to be more private sector oriented.

The figures shows an increase in weight of the software and services components, while mature markets like the hardware ones (servers, storage, printers) are free falling. The hardware market is still somehow sustained by the arrival of netbooks.

The most dynamic components of the software market currently tend to be, middleware applications and system software applications. There is also demand for open source software, as well as for security and system management solutions, IT management and monitoring solutions, and application servers as a solution for complex application integration issues. E-commerce applications are also growing quickly. Information security applications are also important for Italian companies in all sectors, as well as business intelligence and data warehouse applications through ERP, SCM and CRM solutions.

The security market presents an interesting growth trend. Virtualization is also developing strongly on this market. Nevertheless, the applications software market remains at a low level for the SMB segment, as their current budgets are rather reduced.

The services sector is currently sustained by embedded systems, outsourcing, system integration and to a lesser extent by consulting. The telecommunications sector, one of the largest in the EU, is being driven by the convergence between traditional telecommunications and media. In the telecom area, the mobile and mobile data sectors remain motors for growth. New contents and services in this area are expected to positively influence the sector.

Overall IT investment remains very low in the Italian economy, in addition to a low level of innovation compared to the other top five European countries. This will eventually contribute to an even more accentuated slowdown for the Italian ICT market. There is also an obvious reduction predicted by the consumption curb, as well as a constant decrease in the use of ICT in the public sector.

Decentralization and business transparency are also expected to exert a positive impact on the development of ICT. The government is encouraging SMB companies to adopt e-commerce and turn to broadband access.

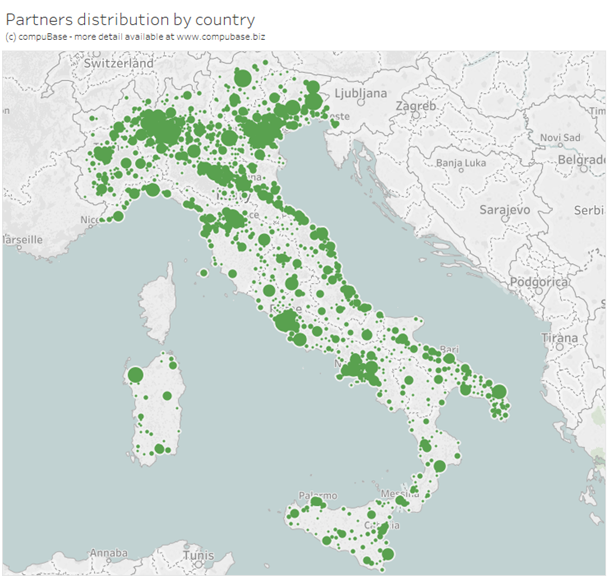

The following image shows the concentration of ICT partners in our database for Italy.

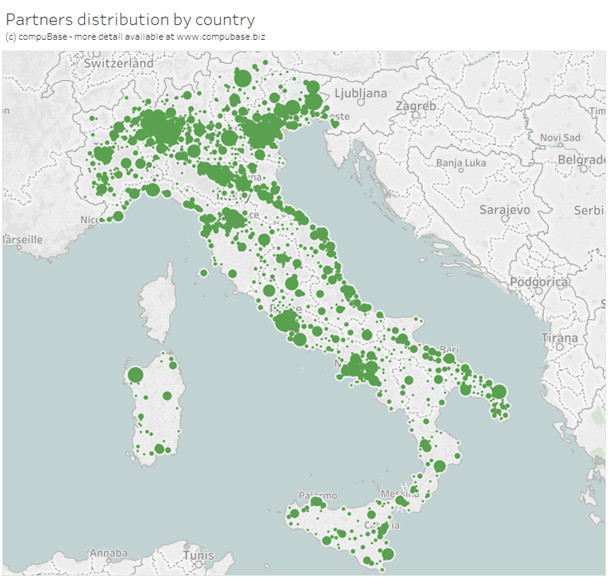

The Italian ICT market is currently experiencing an increase in the grey economy and a dominance of American companies on the market, since most of them own an Italian subsidiary. At regional level, Lombardy is considered the region with the most highly developed ICT activity, with altogether more than a quarter of the main channel players. Emilia Romagna, Lazio and Veneto each share 10% of the channel players. The other 40% are spread all over the country. Due to the channel’s granularity, local wholesalers have gained more and more importance in ICT distribution. With the emergence of new business models, the number of VARs has also increased compared to the past few years: they currently represent 49% of channel players. Demand in the public sector has also reduced as only 34% of the resellers currently address this market. They tend to be more private sector oriented.

The figures shows an increase in weight of the software and services components, while mature markets like the hardware ones (servers, storage, printers) are free falling. The hardware market is still somehow sustained by the arrival of netbooks.

The most dynamic components of the software market currently tend to be, middleware applications and system software applications. There is also demand for open source software, as well as for security and system management solutions, IT management and monitoring solutions, and application servers as a solution for complex application integration issues. E-commerce applications are also growing quickly. Information security applications are also important for Italian companies in all sectors, as well as business intelligence and data warehouse applications through ERP, SCM and CRM solutions.

The security market presents an interesting growth trend. Virtualization is also developing strongly on this market. Nevertheless, the applications software market remains at a low level for the SMB segment, as their current budgets are rather reduced.

The services sector is currently sustained by embedded systems, outsourcing, system integration and to a lesser extent by consulting. The telecommunications sector, one of the largest in the EU, is being driven by the convergence between traditional telecommunications and media. In the telecom area, the mobile and mobile data sectors remain motors for growth. New contents and services in this area are expected to positively influence the sector.

Overall IT investment remains very low in the Italian economy, in addition to a low level of innovation compared to the other top five European countries. This will eventually contribute to an even more accentuated slowdown for the Italian ICT market. There is also an obvious reduction predicted by the consumption curb, as well as a constant decrease in the use of ICT in the public sector.

Decentralization and business transparency are also expected to exert a positive impact on the development of ICT. The government is encouraging SMB companies to adopt e-commerce and turn to broadband access.

The following image shows the concentration of ICT partners in our database for Italy.

Database Italy - Click on any cell in the table to see the corresponding selection

FURTHER SOURCES OF INFORMATION

Distribution players:

ESPRINET S.p.A. ; INGRAM MICRO ITALIA S.p.A. ; TECH DATA ITALIA S.r.l. ; COMPUTER GROSS ITALIA S.P.A.

IT Channel Press & Players:

CRN (VNU) ; Top Trade Informatica (VNU)

Public organisations & Useful Associations:

FISTEL CISL, Associazione Italiana per l'Information Technology (ASSINFORM), Associazione Nazionale delle Imprese ICT (ASSINTEL)

ESPRINET S.p.A. ; INGRAM MICRO ITALIA S.p.A. ; TECH DATA ITALIA S.r.l. ; COMPUTER GROSS ITALIA S.P.A.

IT Channel Press & Players:

CRN (VNU) ; Top Trade Informatica (VNU)

Public organisations & Useful Associations:

FISTEL CISL, Associazione Italiana per l'Information Technology (ASSINFORM), Associazione Nazionale delle Imprese ICT (ASSINTEL)

Consulting Services

Consulting Services