EMC is the latest in a long list of companies to be acquired by Dell: Credant Technologies, Gate Technologies, Quest Software, Clerity Solutions, Wyse, SonicWall - which were all bought in 2012- and it follows a break after Dell’s exit from the stock exchange in 2013. Only StatSoft was acquired in 2014.

The acquisition will have quite an impact on the IT ecosystem, particularly as EMC is not just a storage manufacturer but also a group with majority shares in VMWare, RSA and Pivotal, so different IT markets will be affected: storage, virtualization, the cloud and security.

The thing is, major historical IT players have to play it both ways: they absolutely have to retain a critical size to be able to cope with price reductions, hence the successive waves of acquisition and consolidation, but they also need to create value by abandoning the hardware part of their offering. In other words, hardware is bought for current business and software for the future.

The acquisition will have quite an impact on the IT ecosystem, particularly as EMC is not just a storage manufacturer but also a group with majority shares in VMWare, RSA and Pivotal, so different IT markets will be affected: storage, virtualization, the cloud and security.

The thing is, major historical IT players have to play it both ways: they absolutely have to retain a critical size to be able to cope with price reductions, hence the successive waves of acquisition and consolidation, but they also need to create value by abandoning the hardware part of their offering. In other words, hardware is bought for current business and software for the future.

That EMC has been bought is also indicative of the trouble mono product leaders have with the large accounts target. They always get caught up at some point in time by competitors with similar products, initially positioned as entry-level products, which then benefit from the booster that is the SME market, to attack the large accounts with a competitive pricing structure and a solid installed customer base.

This is similar to how Microsoft, at the time, ultimately ejected Novell from the comfortable place it had found and where it had fallen asleep on the OS networks’ market.

On paper one may well be a bit skeptical. Some see this consolidation strategy as an old-fashioned approach. Dell will have to manage a huge cultural difference. What will remain of the “bride” once the restructuring, which must inevitably happen, is over? But with HP in the ranks for the acquisition, did Dell really have any choice? Michael Dell does have a major advantage though. As Dell is no longer a listed company, he can now envisage a strategy that doesn’t require thinking in terms of quarterly results. Let’s give it a little time to see if this acquisition isn’t a cover up for something else that would give the operation more sense, for example, the acquisition of a Cloud hosting company or a service structure.

This is similar to how Microsoft, at the time, ultimately ejected Novell from the comfortable place it had found and where it had fallen asleep on the OS networks’ market.

On paper one may well be a bit skeptical. Some see this consolidation strategy as an old-fashioned approach. Dell will have to manage a huge cultural difference. What will remain of the “bride” once the restructuring, which must inevitably happen, is over? But with HP in the ranks for the acquisition, did Dell really have any choice? Michael Dell does have a major advantage though. As Dell is no longer a listed company, he can now envisage a strategy that doesn’t require thinking in terms of quarterly results. Let’s give it a little time to see if this acquisition isn’t a cover up for something else that would give the operation more sense, for example, the acquisition of a Cloud hosting company or a service structure.

Meanwhile, we’ll take a look at the impact on the distribution networks and see in which ways Dell’s and EMC’s networks are complementary.

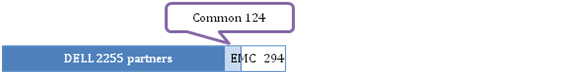

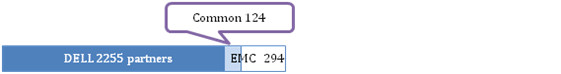

The following studies do not cover all of the partners for either of the brands, but just those partners that claim Dell or EMC feature in the top 3 brands they sell.

Network size

Net gain in potential partners: 358 (+5.4%)

Target market: SMEs (partners targeting companies with fewer than 250 employees)

Net gain in potential partners: 289 (+6%)

Target market: Large accounts (partners targeting companies with over 500 employees)

Net gain in potential partners: 170 (+7.5%)

Target market: Security (companies claiming to be skilled in security or selling security solutions)

Net gain in potential partners: 299 (+5.9%)

Target market: Cloud (companies claiming to be skilled in the Cloud)

Net gain in potential partners: 123 (+18%)

Target market: Virtualisation (companies claiming to resell virtualisation software)

Net gain in potential partners: 196 (+15.9%)

The acquisition of EMC means that Dell can

The question on everyone’s lips now…How is HP going to react?

By Jack Mandard

- Provide its already broad network a high value-added offering in storage, but also in security solutions via the brand RSA

- Gain market penetration in the strategic large accounts sector with a recognized brand

- Gain ground with partners that are already positioned on the private cloud market

The question on everyone’s lips now…How is HP going to react?

By Jack Mandard

Consulting Services

Consulting Services